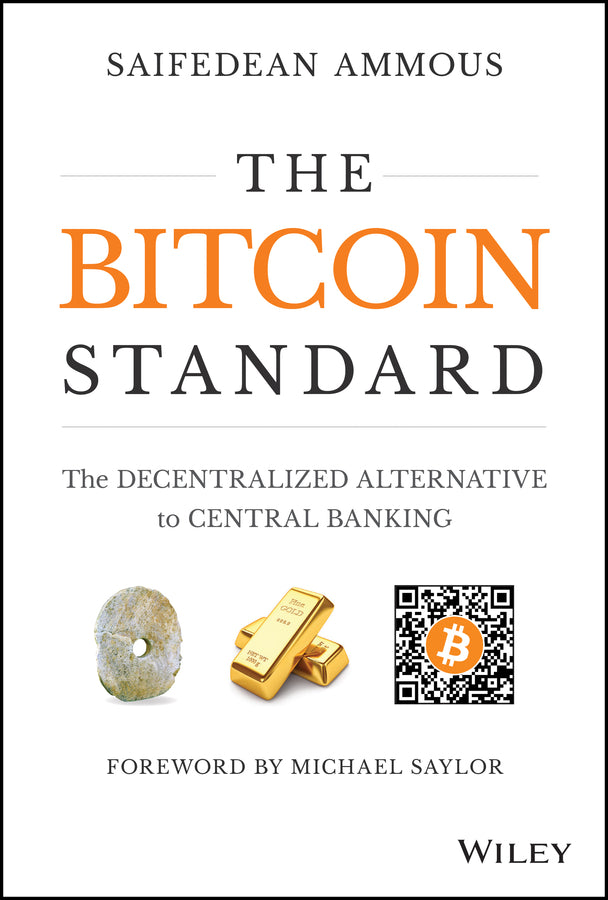

Saifedean Ammous

The Bitcoin Standard

The Bitcoin Standard

Couldn't load pickup availability

Gabi's Review

Any citizen of any nation can own and sell Bitcoin. It is a currency or hard asset that transcends national boundaries, requires no financial institution for its custody, and offers an alternative to centralised banking fee structures and fiat currency devaluation. But isn't it also the domain of moon boys, geeks and crims? With the inauguration of Donald Trump on Jan 26 2025, and with a potential US Bitcoin Federal Reserve, Bitcoin is something we can no longer ignore. In addition, sovereign wealth fund purchases of cryptocurrency in 2024 leave us no choice but to rethink the value of this asset. Saifedean Ammous's book The Bitcoin Standard educates us into a greater understanding of this technology.

The author begins by giving a solid history of the evolution of money and the advantages it has bestowed. While the adage "money is power" is familiar, perhaps it is more accurate to say that money is the language of power. Money has a linguistic function in so far as it nothing more than an agreed denominational narrative represented by an object; it has no intrinsic value other than what we ascribe to it. Historically this transactional medium ranged from any object of scarcity and value from shells to gold. Ammous explains, simply and concisely, why money be summarised as a tool for the transference of purchasing power across time and space..

He tells us that gold, for example, is great as a store of value that has purchasing power across time, because its scarcity maintains its value. However, gold is not great at moving purchasing power across space because it is physical and heavy. With increased global connectivity we needed a more flexible form of money. Fast forward to fiat currency, the coin or dollar, affording greater transactional facility. The author proceeds to argue that money is failing both individuals and nations as a store of value, due to the inherent flaw of arbitrarily increasing supply.

Bitcoin was unleashed on the world by Satoshi Nakamoto in 2009 in response to the fiasco of the Global Financial Crisis and the perceived need for what Ammous calls "sound money". The printing of money by centralised authorities (governments) responding to crises ultimately devalues the dollar and leads to inflation. In a reductive analysis, money printing is a tax paid by the working class, many of whom do not own assets which appreciate. This goes partway to explaining the ideological appeal of Bitcoin to the less economically advantaged.

Bitcoin is essentially a decentralised digital ledger whose encryption technology makes it unique. Unlike gold or fiat currency, Bitcoin has a finite supply, 21 million to be exact and no more can be created. With the benefit of encryption, it can be transacted peer to peer without the need of an intermediary. No wonder the banks aren't enamoured with the concept! It is "mined" (don't ask, read about it) in blocks by miners distributed around the world. In addition, it is cleverly designed to diminish in halving cycles, slowing its rate of production for measured scarcity. Bitcoin is currently in its fourth halving cycle, with over a hundred and thirty years to go before the last bitcoin is mined.

In Ammous's own words; "Bitcoin can be understood as a sovereign piece of code, because there is no authority outside of it that can control its behavior." Clear as mud? So imagine a new money token, not held or transacted through a bank whose value increases over time due to its scarcity. If I lacked the skill to have made it clearer for you, I urge you to read the book to understand the potential impact of a new monetary system with implications for individual freedom and prosperity.

Publisher's Review

A comprehensive and authoritative exploration of Bitcoin and its place in monetary history.

When a pseudonymous programmer introduced "a new electronic cash system that’s fully peer-to-peer, with no trusted third party" to a small online mailing list in 2008, very few people paid attention. Ten years later, and against all odds, this upstart autonomous decentralized software offers an unstoppable and globally accessible hard money alternative to modern central banks. The Bitcoin Standard analyzes the historical context to the rise of Bitcoin, the economic properties that have allowed it to grow quickly, and its likely economic, political, and social implications.

While Bitcoin is an invention of the digital age, the problem it purports to solve is as old as human society itself: transferring value across time and space. Author Saifedean Ammous takes the reader on an engaging journey through the history of technologies performing the functions of money, from primitive systems of trading limestones and seashells, to metals, coins, the gold standard, and modern government debt. Exploring what gave these technologies their monetary role, and how most lost it, provides the reader with a good idea of what makes for sound money, and sets the stage for an economic discussion of its consequences for individual and societal future-orientation, capital accumulation, trade, peace, culture, and art. Compellingly, Ammous shows that it is no coincidence that the loftiest achievements of humanity have come in societies enjoying the benefits of sound monetary regimes, nor is it coincidental that monetary collapse has usually accompanied civilizational collapse.

With this background in place, the book moves on to explain the operation of Bitcoin in a functional and intuitive way. Bitcoin is a decentralized, distributed piece of software that converts electricity and processing power into indisputably accurate records, thus allowing its users to utilize the Internet to perform the traditional functions of money without having to rely on, or trust, any authorities or infrastructure in the physical world. Bitcoin is thus best understood as the first successfully implemented form of digital cash and digital hard money. With an automated and perfectly predictable monetary policy, and the ability to perform final settlement of large sums across the world in a matter of minutes, Bitcoin's real competitive edge might just be as a store of value and network for the final settlement of large payments a digital form of gold with a built-in settlement infrastructure.

Ammous' firm grasp of the technological possibilities as well as the historical realities of monetary evolution provides for a fascinating exploration of the ramifications of voluntary free market money. As it challenges the most sacred of government monopolies, Bitcoin shifts the pendulum of sovereignty away from governments in favor of individuals, offering us the tantalizing possibility of a world where money is fully extricated from politics and unrestrained by borders.

The final chapter of the book explores some of the most common questions surrounding Bitcoin: Is Bitcoin mining a waste of energy? Is Bitcoin for criminals? Who controls Bitcoin, and can they change it if they please? How can Bitcoin be killed? And what to make of all the thousands of Bitcoin knockoffs, and the many supposed applications of Bitcoin's 'block chain technology'? The Bitcoin Standard is the essential resource for a clear understanding of the rise of the Internet's decentralized, apolitical, free-market alternative to national central banks.

Share